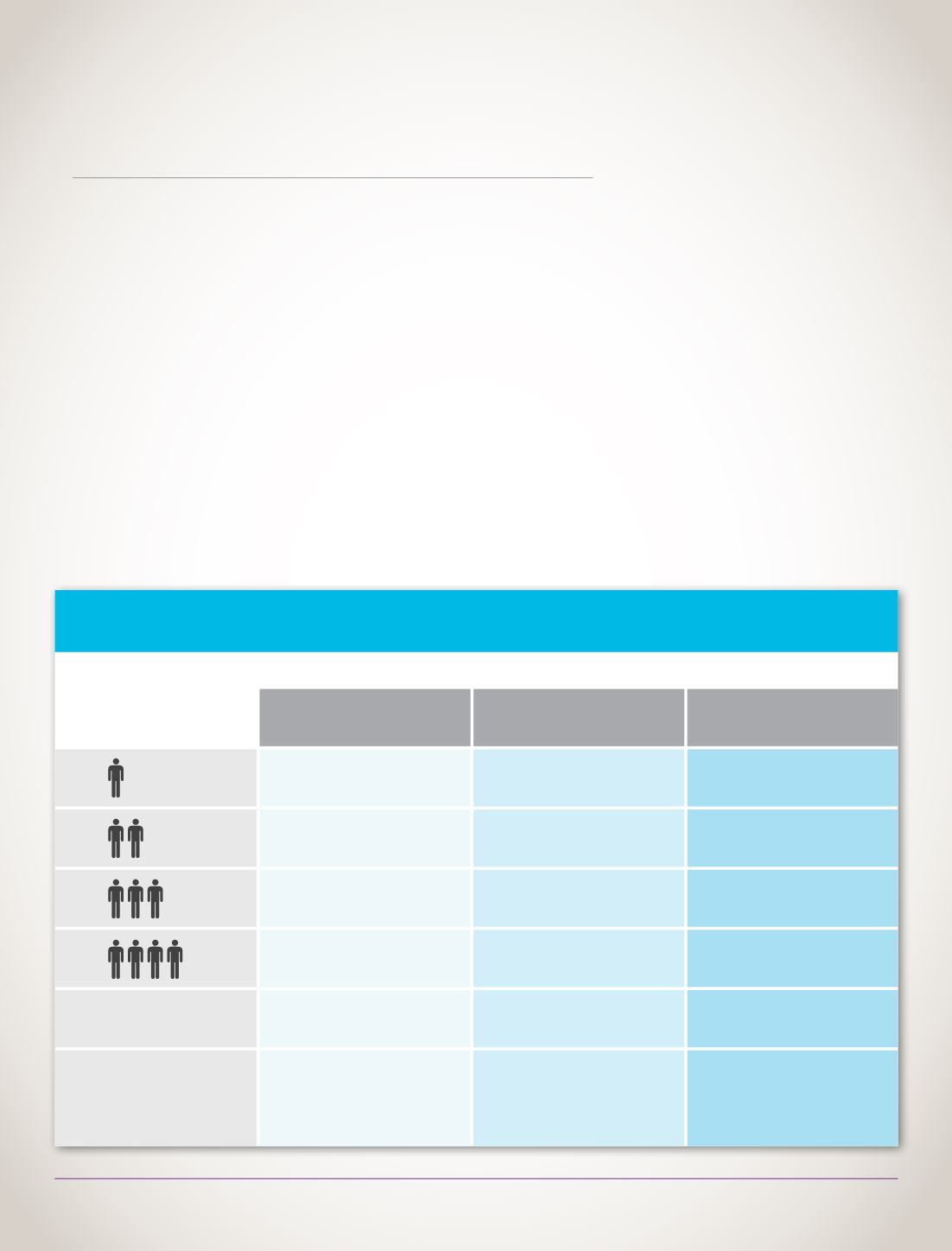

2014 Plan Year Federal Poverty Level Guidelines

100%

$11,670

$15,730

$19,790

$23,850

$4,060

$29,175

$39,325

$49,475

$59,625

$10,150

$46,680

$62,920

$79,160

$95,400

$16,240

250% 400%

1

2

3

4

Each Additional

Person Adds

Size of Household

Coverage

Information

May Qualify

for Cost-Sharing

Reductions

May Qualify for

Advance Premium

Tax Credits

Percentage of Federal Poverty Level

10

|

2015 Individual & Family Plans

Holding Down

Insurance Costs

Having health insurance means peace of mind, knowing you are covered. Depending on your income and personal

situation, you may be eligible for a variety of discounts and subsidies, too. Going with Dean Health Plan is the smart

choice, especially when you consider the variety of cost-saving possibilities.

Health Insurance Affordability Programs

If you purchase health insurance through the Health Insurance Marketplace, you may be eligible for programs that would

make your health insurance more affordable. Only the Marketplace can determine if you are eligible for, and how much you

can receive under, either of the following programs.

Advance payments of the premium tax credit are available to individuals with household income of at least 100 percent but

not more than 400 percent of the Federal Poverty Level (FPL). Advance payments of the premium tax credit reduce the

amount you have to pay in monthly premiums.

Cost-sharing reductions are available to individuals who have a household income of at least 100 percent but not more than

250 percent of the FPL and are enrolled in a silver tier plan. Cost-sharing reductions reduce the amount you have to pay

towards your deductible, coinsurance and copays.

It’s important to check if you qualify for one or more of these programs based on your income level. The following table shows

the FPL guidelines, but an agent or Dean Health Plan representative can help you if you’re not sure.